Foreword by the President and the CEO

In 2023, SSF implemented its new strategy with a strong focus on member interaction and collaboration with various stakeholders – a strategy which resulted in concrete guidance on many different aspects of sustainable finance. Such guidance is increasingly needed, as the sustainable finance arena is getting more and more complex. Differing regulation in different legislations, high expectations on the role of finance in enabling the transition into a low carbon economy from politicians and NGOs, and growing client expectations around the demonstration of impact in combination with attractive risk/return-profiles: these are only some of the reasons why navigating the growing sustainable finance field has become increasingly challenging for financial market actors. In such a situation, it is key to build on shared knowledge on best ways forward.

One project relying on shared knowledge was the development of the Swiss Stewardship Code. In a joint working group between SSF and the Asset Management Association Switzerland (AMAS) we developed this Swiss standard for implementing effective investor stewardship, jointly with different types of SSF members ranging from asset managers and service providers to asset owners. Given that engagement and voting are important ways to achieve investor impact, this Stewardship Code represents a milestone for further progress on achieving a leading center in sustainable finance.

On the side of SSF, 2023 marked a generational change in the SSF team. With Jean Laville and Kelly Hess two SSF staff of the first hour set off for new shores. We thank both of them for their long-year engagement for our association and look forward to working with our new colleagues bringing fresh ideas to the team, with our new Director Romandie Daniela Lavrador already having taken up her role. We are proud of the growing members base that contributes to our activities and relies on our support. Approaching our 10-year anniversary we thank all of them for making us a strong voice in the Swiss financial centre around all aspects of sustainable finance.

Patrick Odier

SSF President

Sabine Döbeli

SSF CEO

SSF Strategic Priorities in the Year 2023

SSF has 4 strategic priorities, which it enacts through 10 activity fields.

SSF Strategic Priorities

Informing on best practice

Activity 1: Sustainable finance information

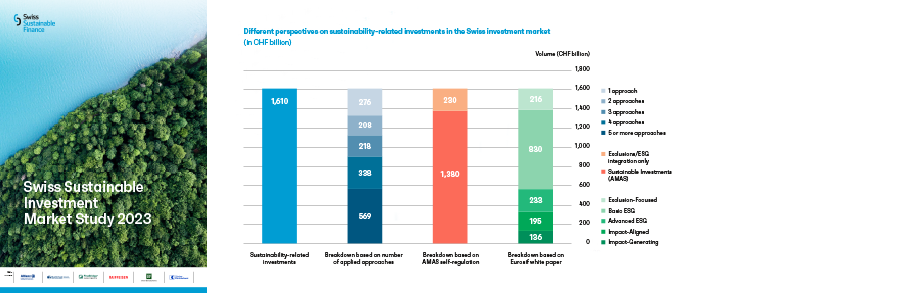

For more information see Market Study 2023 website.

For more information see Market Study 2023 website.

- TCFD Disclosure – Guidance and Best Practice in the Swiss Context

- Swiss Stewardship Code (in collaboration with AMAS)

- SSF Spotlight: Sustainable Real Estate Investments: Insights for Direct Real Estate investors

- SSF Spotlight: The Role of Derivatives in Sustainable Investing

- 11 December - "SSF Spotlight: The Role of Derivates in Sustainable Investing

- 3 November- "SSF Spotlight on sustainable real estate investments highlights key drivers for sustainable buildings"

- 4 October - "Effective sustainable investment: the Asset Management Association Switzerland and Swiss Sustainable Finance launch the “Swiss Stewardship Code""

- 24 August - "Swiss Sustainable Finance publishes guide on climate reporting for financial service providers"

- 27 June- "Swiss Sustainable Investment Market Study 2023” by Swiss Sustainable Finance: Reduced volume of sustainability-related investments in Switzerland mirrors negative overall market performance - trend towards impact-related investments persists"

- 23 June - "Annual Conference of Swiss Sustainable Finance (SSF) highlights important role of fi-nancial sector in the transition to a sustainable future – Christine Gugolz joins SSF Board"

- 23 February - "Swiss Sustainable Finance (SSF) launches E-learning module for institutional investors"

Activity 2: Sustainable finance events

Creating supportive tools

As part of the new strategy, SSF introduced four member platforms to create supportive tools in different areas. For each of these platforms, two annual meetings are held to inform about key activities and lead a dialogue with members about future needs. Each platform is supported by different focus groups. Read about the various activities of the four platforms and different focus groups below.

Activity 3: Sustainable Finance Education

- Education for client advisors (related to SBA self regulation)

- Gamification in education around climate and biodiversity

SSF moved all its published e-learnings into the SSF academy and published a new e-learning specifically for asset owners.

*As of 25.01.2024 : https://ssfacademy.learnworlds.com/author/userprogress

SSF moved all its published e-learnings into the SSF academy and published a new e-learning specifically for asset owners.

*As of 25.01.2024 : https://ssfacademy.learnworlds.com/author/userprogress

Activity 4: Sustainable Investing

This annual, reoccurring focus group is called into action in late summer each year and serves as a sounding board for changes to SSF’s annual survey which serves as the basis for our flagship publication on sustainable investments. SSF and focus group members debate and approve improvements/amendments to the market study survey, helping SSF’s survey evolve with the constantly changing industry to capture the most important market data related to sustainable investing.

1

Sustainable Investment Market Study 2023 published

>200attendants to the launch webinar

This focus group analysed the challenges of using of derivatives in sustainable funds and mandates and supported the SSF team in preparing a report providing guidance to banks and asset managers on how to apply these instruments in a sustainable investment context.

1workshop held in 2023

1SSF Spotlight report published: “The Role of Derivatives in Sustainable Investing”

This focus group discusses issues related to active ownership in wealth management. Its objective is to identify key challenges linked to the execution of voting rights in the context of discretionary mandates and discuss possible solutions.

2meetings held in 2023

2rounds of feedback provided on the Swiss Stewardship Code

This focus group aims to promote further adoption of investments with impact by identifying key issues related to definitions, frameworks, impact measurement and reporting.

2meetings held in 2023

1workshop held with impact investing stakeholders

40responses received to a survey on impact definitions

SSF and the Global Compact Network Switzerland and Liechtenstein (GCNSL) are co-conveners of the Swiss Consultation Group (CG) to the Taskforce on Nature-related Financial Disclosures (TNFD). The role of the Swiss TNFD CG is to build knowledge and capacity of the TNFD within their network. The Swiss TNFD CG consists of SSF members, GCNSL members and Swiss TNFD Forum members.

2webinars held in 2023

2workshops held in 2023

At the end of 2023, the federal council decided on further development of the Swiss Climate Scores. As SSF and the AMAS developed a template for the first version of the Swiss Climate Scores, the two associations decided to also develop an updated template based on the revised Scores. A first meeting was held with the respective focus group at the end of 2023. An updated template will follow in the first half of 2024.

Activity 5: Sustainable Financing

Activity 6: Institutional Asset Owner

Together with the SSF secretariat, this focus group identifies topics and partners suitable for asset owner workshops. These workshops are exclusively directed at representatives of institutional asset owners (pension funds, insurers, foundations, single family offices).

4workshops for Institutional Asset Owners held in 2023, of which three in English and one in French

2of these were collaborative with PRI and GIIN respectively

Shaping Swiss frameworks

Activity 7: Political Dialogue

1Parliamentary event held

On 5 December 2024, SSF organised a parliamentary event on the role of finance for the transition to net-zero. The discussion with parliamentarians provided insights on the levers and limitations of finance in supporting the transition to a low-carbon economy.

Activity 8: Collaboration with finance associations

3

finance associations with regular contact and collaboration

SSF is in a regular exchange with other finance associations on various sustainable finance topics. The AMAS/SSF Expert Commission on Sustainable Finance serves as a sounding board for joint activities of the two associations. The joint working group on the Swiss Stewardship Code resulted in the launch of the code in autumn 2023. While SSF is a guest member of the Expert Committee on Sustainable Finance of SBA, SBA joins different SSF activities as a guest. SSF further is in a regular exchange with the Swiss Insurance Association about key developments in sustainable investing.

Engaging key stakeholders

Activity 9: Dialogue with Representatives of the Swiss Economy

Activity 10: Collaboration and Exchange with International Peers

- SSF represents Zurich in the UN-convened Financial Centres for Sustainability (FC4S) network and prepared the input for the annual assessment program of the network resulting in a report on frameworks for sustainable finance. SSF further is in a regular dialogue with FC4S on key initiatives relevant for Swiss finance actors and attended their Annual General meeting to discuss future activities of the network.

- SSF is a member of Eurosif and participates in their policy and sustainability-related investment work prepared by this pan-European body uniting national sustainable finance organisations.

SSF as an organisation

SSF members and network partners

At the end of 2023, SSF was supported by a total of 246 organisations (216 members and 30 network partners), which reflects a growth of 6% compared to the previous year. See the member profiles on the SSF website.

SSF Board

The SSF Board has 14 members representing different member types and regions. In 2023, SSF elected one new member to the SSF Board. Patrick Odier is serving his third year as President of SSF. View the profiles of the current board members on the SSF website.

SSF Team

The SSF Secretariat has 8 team members, all of which are providing their individual know-how and expertise to the organisation. See their profiles on the SSF website. At the end of 2023, Jean Laville retired from his position as Director Romandie. Read a short interview with him here. By 1 January 2024 he was replaced with Daniela Lavrador, joining as the new Director Romandie.